A220, 2019 perspective

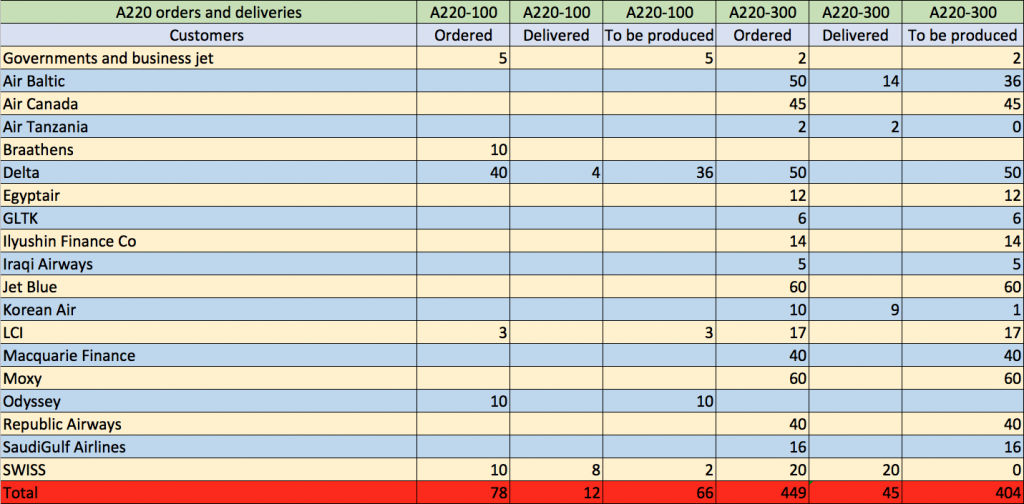

Every month, Airbus publishes an Excel spreadsheet showing the orders and deliveries of civil aircraft, so here is the table with the official figures for the A220.

The surprise comes from the first row where Airbus says it has won seven orders from governments and / or business jet buyers (five A220-100s and two A220-300s), which is comparable to the three orders of ACJ-319NEO and six of ACJ-320NEO.

With the latest adjustments, the A220-100 represents only 15% of the A220 family’s order book. This is not really surprising since it is around the A220-300 that this aircraft program has been designed and that it is he who offers the best economic return. Since the A220-100 is the shortened version, it does not offer the same performance per seat/mile available as the A220-300. But since it is lighter and can be equipped with the PW1524G, it will make a very good niche aircraft for short runway, high altitude and steep approaches.

Airbus states that it delivered 20 A220s between July 1 and December 31, 2018, including eight for the month of December alone. To reach this number it includes the second Air Tanzania A220-300 as well as the twentieth of SWISS. The departure date from Mirabel for these two aircraft being January 9 and 10, 2019, implies that these two companies agreed to pay for the planes before the end of 2018 more than 10 days before taking possession of them; certainly Airbus has offered a small incentive …

The number of deliveries in January should be rather low since at this moment there is no more aircraft in the pre-delivery loop. Even if there were only one or two deliveries in January, we believe that Airbus should be able to significantly increase the production rate in 2019 and deliver between 55 and 60 A220s. For those who find us optimistic, here are the reasons that we believe will allow Airbus to arrive at this number.

In addition to supplying the 66 engines to the A220 assembly line in 2018, during the second half of the year, Pratt and Whitney also replaced more than 50 engines on aircraft already in service. The production capacity of Pratt & Whitney is therefore able to meet the production rate of 55 to 60 A220. The only obstacle for Pratt & Whitney is that it might be forced to make further corrections following the failure of the Korean Air engine on December 27th.

One of the suppliers of the A220 to have experienced the most difficulties is Zodiac; the latest corrective actions appear to have give positive results. It is for this reason that Airbus has chosen to erect two more temporary shelters in order to work on finishing a larger number of aircraft.

Once the Alabama Mobile plant is in production, Delta Airlines should take the outgoing aircraft rather than those produced at Mirabel. Despite an opening planned for the end of 2020, it is not until the beginning of 2022 that the maximum rate of four aircraft per month will be reached. Since Jetblue and Moxy orders will also be manufactured in Mobile, Delta Airlines has every interest in taking as many A220s as possible from Mirabel, as the Mobile plant will only be able to deliver a few aircraft in 2020. and barely more than one per month to Delta in 2021.

As for new orders, three big European names are to remember:

Air France has a fleet of 34 A319s with an average age of 17.7 years; the company could launch the formal process of renewing part of its fleet in the coming months.

Lufthansa still has options for 30 A220s while its fleet of 30 A319s has an average age of 16.9 years. In the summer of 2017, she came close to placing an order for aircraft the size of the A220 and E2, but the bankruptcy of Air Berlin forced her to review her plans. The question is whether Lufthansa still needs an aircraft of the size of the A220.

The third large airline on our list is EasyJet, the three subsidiaries combined operate 125 A319s. Although the average age of this entire fleet is almost 10 years, the first deliveries date back to 2002. An order with 2021 as the first date of delivery would be quite possible.

There is also the order for 30 additional A220-300s that AirBaltic is expected to pass by the end of 2019.

In North America, it’s probably Spirit Airlines that will be the next airline to place an order. United Airlines is also studying the possibility of placing an order for aircraft from 100 to 135 passengers. But this order is of utmost importance for E2 and it’s a safe bet that Boeing is doing everything it can to get it, even sell below production cost (this this sound familiar).

A little surprise could come from Jetlines; Jennifer Paterson, Director of JetLines Corporate Development, has confirmed to us by email that the order for 5 B737 MAX7 is no longer in effect. JetLines, which has just completed a first round of financing, intends to operate an entire Airbus fleet; will it overtake Porter Airlines and be the second Canadian company to place a firm order of A220?

It is during this year that Airbus should start making changes to the assembly line of the A220 to improve productivity. We do not expect major perturbation, but rather several small changes that will be made gradually so as not to affect the rate of production.

When Bombardier planned the production of the C Series, there was to be a supplier center next to the assembly line in Mirabel. Pratt & Whitney, Leonardo, UTC are among the suppliers who had to have their own building. The purpose was to allow suppliers to complete the last assemblies in a building other than the assembly line. It was in the premises of the supplier center that the quality inspections were to be carried out to confirm the acceptance of the assemblies and parts. If corrections were to be made, this is where they should have been made. Airbus might be moving forward with the supplier center in 2019. Combined with the price revision, it is the suppliers that should touched with be the biggest change in 2019.

>>> Follow us on Facebook and Twitter